Employee benefits

Our greatest resources are our people, and that is why we offer an impressive total compensation package.

Explore the drop-down menus to learn about our excellent benefit programs.

Kentucky Cattle Auction Report - July 1, 2025

Locals Craft World-Class Protective Gear Right Here in KY

LION Group, Inc.'s V-Force turnout gear was recently named the 'Coolest Thing Made in Kentucky' in tournament-style contest

It turns out that the coolest thing made in Kentucky is used in some very hot situations. LION Group, Inc.’s V-Force® turnout gear, which protects firefighters in the U.S. and across the globe and is manufactured in the Kentucky communities of West Liberty, Beattyville, and Hazel Green, has won the Kentucky Association of Manufacturers’ (KAM's) 2025 Coolest Thing Made in Kentucky Tournament presented by Kentucky Farm Bureau Insurance in a two-month long contest that garnered more than 320,000 votes.

LION V-Force turnout gear defeated Texas Roadhouse Mini Rolls, made by T. Marzetti Company in Horse Cave, Kentucky, by a 57%-43% margin in the tournament finals.

“Since 1959, Kentuckians have been sewing and distributing LION’s high-performance uniforms and protective garments to first responders around the world. But our history is not just about nearly 70 years of sewing products in Kentucky; it's about the dedication, passion, creativity, and hard work of our more than 600 Kentucky-based manufacturing team members,” said Steve Schwartz, CEO and fourth-generation family owner of LION Group. “They hand-sew each set of V-Force turnout gear we ship to firefighters that protects them in extreme conditions so they can protect their communities. Knowing that what they create is cherished and celebrated as the 2025 Coolest Thing Made in Kentucky fills all of our hearts with immense pride.”

Now in its third year, the annual online voting, bracket-style tournament gives Kentuckians the opportunity to pick their favorite from among the thousands of world-class products manufactured in the commonwealth.

A FIRSTHAND PERSPECTIVE

Alan Perkins has been an employee at LION Group, Inc. since 1985, making him one of the longest tenured employees at the West Liberty facility. But perhaps more important is the fact that Perkins, during many of these years, has also been a county first responder.

“I was born and raised in Morgan County, and I started working at our local ambulance service in 1994,” he said. “I’ve also been a member of the county’s rescue squad.”

Perkins has worn LION’s gear during rescue moments and knows firsthand how important it is to keep frontline workers safe.

“I’ve worn this gear and been protected by it,” he said. “And by working here and seeing all the places our gear goes to, I know it’s protecting those firefighters, too.”

Perkins added that everyone working for LION understands that the gear they are making will help save the lives of first responders.

Diane Best is the site leader at LION’s Beattyville facility. She has been with the company for more than 40 years.

“The company is family owned and has been in business for 127 years, with its headquarters in Dayton, Ohio,” she said. “There are three facilities in eastern Kentucky, and each of the plants have different jobs all connected in getting the finished garments ready to ship to firefighters and first responders around the world.”

Best added that V-Force was created to give maximum comfort and mobility to firefighters who wear it.

“The comfort and mobility features that are built into the gear actually allows firefighters the ability to work comfortably,” she said. “When it was created, it was built to move like the human body moves.”

The Jessamine County Fire Department uses LION V-Force gear. Jason Walton is Fire District Assistant Chief. He said it is great to have such important firefighting gear made right here in the state.

“The departments of Kentucky are lucky to have a manufacturer like LION that knows the industry so well and has designed and tailored a set of personal protective equipment that matches what our needs are,” he said. “These are built to the highest standard and are above the National Fire Protection Association (NFPA) recommendations. They build something that is far superior to just the minimum standard.”

When asked if he thinks his fellow firefighters are safer using the LION Group Inc.’s V-Force turnout gear, his reply was, “Most definitely.”

IFAL is 40 and Still Going Strong

In 1986, Martha Layne Collins was governor, Ferdinand won the Kentucky Derby, a gallon of gas averaged 86 cents, and Kentucky Farm Bureau (KFB) was about to embark on a youth program that would help shape the future of agriculture for decades to come.

In 1986, Martha Layne Collins was governor, Ferdinand won the Kentucky Derby, a gallon of gas averaged 86 cents, and Kentucky Farm Bureau (KFB) was about to embark on a youth program that would help shape the future of agriculture for decades to come.

The Institute for Future Agricultural Leaders (IFAL) brings rising high school seniors to a five-day event to educate them about the organization, acquaint them with the top agriculture issues of the day, and help them begin their leadership journeys.

Forty years later, the program remains as strong as ever and boasts a who's-who of today's top state leaders in agriculture, local and state government, and county Farm Bureaus, spanning all 120 counties.

Taylor Nash, IFAL class of 2015, now oversees the program as the KFB Federation’s Director of Young Farmer programs. He said the goal of IFAL is to help students see how they can fit agriculture into their future through a variety of activities.

“The students come to spend a week with us at one of our participating universities (the University of Kentucky and Murray State University) to help expose them to college, experience what it's like to be on campus, help them see how they can fit agriculture into their futures by taking them on ag-related visits and participating in agricultural discussions.”

Nash noted the importance of a program like IFAL as a way to get young people involved in Farm Bureau, as well.

“These students are the future of our industry, and, in many ways, they're already leading it at their age, and so we want to find a way to help engage them and help set them up with the resources that come with being involved with KFB,” he said.

Like so many others who have become IFAL alumni, Nash said his experience made a lasting impression on him.

“As a student, I loved it and it was the first time that I ever left home by myself,” he said. “I'd been involved in FFA and gone with my school to various places and events, but this was the solo trip for me and where I was pushed out of my comfort zone to get to meet new people. And I would've never guessed the people that I met there. Now I get to work with them in different capacities.”

Nash noted that many people who were involved in his IFAL group have gone on to leadership roles at all levels and serve as resources for him in his present position.

A FAMILY TRADITION

LaRue County Farm Bureau President Jeremy Hinton, a 1991 IFAL participant, began a tradition for his children, as two of them have now gained the title of IFAL alumni. Jacob attended in 2021, while Joslyn just completed her time as a participant.

Jeremy said the program helped shape his college experience and steered him toward agriculture in Farm Bureau.

“At the time, I wasn’t for sure about what college to go to or what I wanted to major in, but attending IFAL helped to solidify my decision to attend UK and major in agriculture,” he said. “It also planted seeds for my future in Farm Bureau.”

Jeremy, who also serves as Chair of the Kentucky Horticulture Council, owns two farm markets as part of his overall farming operation, which includes traditional crops such as soybeans and tobacco.

“I hope my children have had the same experience I did while attending IFAL, to motivate them to be involved in the agriculture industry in whatever way they are able,” he said, “I know they have made friendships that will last them a lifetime.”

Joslyn said having a brother and father who attended IFAL helped her to know more about the program.

“I knew quite a bit about IFAL, and I think it was a good opportunity for me,” she said.

Joslyn already has some farming business experience growing mums for her family’s markets.

“I think that the people I'm meeting here are definitely going to stay in touch in the future and be of help with whatever I decide to do,” she said. “Just making those connections with people around the state is important.”

While many programs of this sort come and go over the years, IFAL has stood the test of time.

“I'm not surprised this program has endured through time, and when I think about my experience as a participant and just knowing how many students have gotten that opportunity since,” Nash said. “IFAL has had such an impact on so many over the 40 years of the program, and it has shaped Kentucky agriculture throughout the years and will continue to do so for years to come.”

Nash added that there are many people and organizations that have helped to contribute to the success of IFAL.

“Honestly, I think it's the people we have who are a part of it and the community support that we have,” he said. “We can't go out and create this experience without the farmers and the universities that we get to work with. We have a lot of people here that believe in the future of ag and it starts with these students, and every year we renew that excitement for what's going to come for agriculture through IFAL.”

Being Heard in D.C.

Farm Bureau advocates for American farmers in front of key Senate committee

American Farm Bureau Federation President Zippy Duvall recently testified in front of the Senate Special Committee on Aging to discuss the issue of an elderly farmer population and what can be done to bring a new generation to the agriculture industry. The hearing was entitled, “The Aging Farm Workforce: America’s Vanishing Family Farms.”

Duvall was joined by Jim Alderman of Alderman Farms in Florida; Aaron Locker, managing director of Kincannon and Reed, an executive search and leadership development firm that works with organizations that feed the world; and Dr. Chris Wolf, E.V. Baker Professor of Agricultural Economics and Director of Land Grant Affairs at Cornell University.

“As I travel to farms across this country, I see a lot of gray hair, and while the wisdom of older generations is critical, we must ensure that we are making the way for young and beginning farmers to fill our boots,” Duvall said. “As this committee has identified, there are many challenges facing the agriculture community, but there are also opportunities for Congress to support young and beginning farmers, including with a new Farm Bill.”

Duvall spoke of the need for a modernized, five-year Farm Bill earlier this year before the Senate Agriculture Committee.

“Farmers and ranchers have faced unprecedented volatility since the 2018 Farm Bill, making it harder for many to hold on,” he said in this most recent Senate hearing. “The 2022 census showed the loss of just over 141,000 farms in 5 years … that’s an average of 77 per day.”

Duvall added that, with rising interest rates, higher energy prices, and unchecked supply costs, farmers will plant one of the most expensive crops ever.

“And many will face the tough decision of whether to plant at all,” he emphasized. “This is why the Farm Bill’s Title I safety net is critical.”

In his opening statement, Committee Chair Rick Scott (R-FL) said Congress has not always done right by our farmers.

“The major legislative package aimed at supporting farmers and agricultural workers, the Farm Bill, hasn't passed since 2018,” he said. “This is especially harmful for farmers who have suffered with rising prices for the last four years under the last administration.”

Scott added that while President Trump is having success in breaking down prices and fighting to support American farmers, he needs Congress to act as well, and passing a good Farm Bill is the right place to start.

“Otherwise, we will continue to use outdated information, which compounds the harm done by other economic and regulatory factors,” he said. “As a result, the burden increases on our aging farmers who want nothing more than to see their farm continue in trustworthy hands but are finding it harder and harder to find someone to carry on their legacy.”

The committee’s ranking member, Kirsten Gillibrand (D-NY), said, “Our farmers provide an accessible and abundant supply of food to our whole nation, but with increased consolidation and more farmlands being converted to non-agricultural uses, we are sending ourselves down a very risky path. Our duty in Congress should be to support our farmers whatever way we can.”

Each presenter spoke on several issues facing farmers and the ag industry, primarily focusing on the need to get more young farmers involved to alleviate some of the challenges with an aging farmer population.

"If we want to sustain agriculture in America, we need to smooth the path between generations, which means investing in beginning farmer programs, expanding technical assistance, and offering incentives like estate planning support and making it easier to transfer farms without losing the land or the legacy," Alderman said.

Locker noted several suggestions on how Congress can help address a growing shortage of younger agricultural leaders. Passing a strong, fully funded Farm Bill was one of those suggestions.

“A comprehensive Farm Bill is the foundation of long-term stability for the agriculture industry,” he said. “It empowers rural development, research development, research institutions, and workforce training programs to invest in the future with confidence.”

Duvall added that Congress needs to recognize farmworkers as essential to feeding and fueling our country. It’s time to modernize our outdated system, and only Congress can meaningfully do that.

“A country that cannot feed its people is not secure,” he said. “In order to meet the growing demand for food, fiber, and renewable fuel at home and abroad, we must ensure the continued strength of our farming and ranching communities.”

After his opening statement, Duvall took questions from lawmakers on several issues, including the Adverse Effect Wage Rate, which sets the hourly rate for H-2A guestworkers, the mental health crisis in rural America, international trade deals, and estate taxes. Duvall noted that if farmers are forced to sell their land, the land comes out of production, resulting in it never returning to production.

“There’s so much competition now for land, it prevents young farmers and beginning farmers that want to go into agriculture, God help them, have a difficult time finding that land to do that,” he said. “Availability of land, availability of money, loans, is one of the biggest stumbling blocks young farmers, beginning farmers have going into the business.”

Fireworks safety: 4 keys to having a dynamite Fourth of July

Bottle rockets, Roman candles, and sparklers are all synonymous with one thing in America: the Fourth of July. There’s no doubt that fireworks are fun, but they’re also the culprit of more than 10,000 hospital visits in the U.S. each year. This holiday should be a celebration of our country’s independence, not a reason to go the emergency room. Educate yourself on the rules and risks of fireworks before embarking on your own backyard pyrotechnics show.

- Handle with care.

Each year, thousands of celebrations fizzle out early due to injuries. Mishandled fireworks can result in severe burns, fractures, disfigurement or, worse yet, death. Even a sparkler, usually handed to small children and thought by many to be harmless, burns at 1,200°F. To put that into perspective, wood burns at 575°F and glass melts at 900°F. The tip of a sparkler is hot enough to easily cause third degree burns, thus accounting for more than one-fourth of emergency room fireworks injuries.

Follow these tips to keep you and your family safe while handling fireworks:

- Buy your fireworks from a licensed dealer and read all instructions before lighting. Don’t experiment with homemade fireworks. Sure, they might provide a few seconds of enjoyment, but that’s not worth the risk of injury, scarring or even death that may occur as a result.

- Alcohol and fireworks aren’t a good recipe. Choose an adult who is not consuming alcohol to be the designated fireworks handler.

- Always supervise the kiddos! The risk of fireworks injury is highest for young people ages five to nine.

- Keep a bucket of water on hand and make sure there’s a water hose connected nearby.

- Douse the duds! Wait 20 minutes after attempting to light a dud and soak it in a bucket of water. Never try to relight fireworks that don’t work the first time around!

- Light one firework at a time.

- Never point fireworks at people.

- Keep a safe distance when watching fireworks.

- Light the sky, not your property.

It’s not uncommon for fireworks to send wooded areas, homes and automobiles up in flames. Fire departments annually respond to an average of 18,500 fires caused by fireworks, including 1,300 structure fires, 300 vehicle fires and almost 17,000 outside and other fires.

Fireworks-related fires cause at least $20 million in property loss each year. Bottle rockets or other rocket-type fireworks are an especially large risk to your home, as they can land on rooftops or wedge within a structure while still retaining enough heat to cause a fire.

- Know the law.

A little Fourth of July fun can turn into a run-in with the police in a flash. Laws and ordinances regarding fireworks vary from state to state, and even city to city. To view each state’s fireworks laws by the American Pyrotechnics Association, click here.

- Don’t forget Fido.

While most humans find the earth-shaking boom of fireworks to be enjoyable, most pets do not. In fact, so many frightened pets try to escape the sights and sounds each Fourth of July that lost pet intakes at animal shelters skyrocket. Remember that pets are much more sensitive to the sights, sounds and smells of the holiday than you are. Keep them indoors and away from fireworks displays. If possible, turn on a TV or radio to help drown out the commotion. If your pet seems particularly sensitive to the celebrations, consult a vet who can offer calming techniques and medications to alleviate your pet’s anxiety.

If you keep these tips in mind, your Independence Day celebration will be a blast!

>> At Kentucky Farm Bureau, we’re just as invested in your home as you are. This Fourth of July, light up the sky, not your property! To see a full list of products we insure, click here.

Look before you lock: Six tips to prevent child and pet heatstroke

You pull up to the Post Office. Your little one is strapped in the backseat, soundly asleep, and you just need to hop in and out for a book of stamps. “It will only take a minute,” you think. You make sure the doors are locked and quickly head for the door. What is the worst that could happen?

In 2024, 39 children across the United States died from heatstroke in unattended cars. On average, 37 children under the age of 15 die each year from heatstroke after being left in a vehicle. Nearly every state has experienced at least one death since 1998. In both 2018 and 2019, a record number of 53 children died after being left in a hot vehicle, according to the National Safety Council.

We all know it gets hot outside during the summer, but how can heat stroke happen so quickly?

Think about the weather here locally. The average August temperature in Kentucky is 88 degrees. A car sitting in that temperature can skyrocket past 100 degrees in a matter of only 10 minutes. That can quickly get uncomfortable–or dangerous–for anyone left inside.

Heat stroke sets in when a person’s body temperature exceeds 104 degrees. At 107 degrees, internal organs begin to shut down. It’s important to remember that children and pets are much more susceptible to heat than adults. Children’s body temperatures warm at a rate 3 to 5 times faster than an adult’s, and a pet can go into heat stress in as little as 10 minutes on a hot day. Not only are children and pets more vulnerable, they are also unable to escape, rendering them completely helpless as temperatures swell.

Though it might be hard to understand how something like this can happen, most parents who leave their children behind simply forgot. Work issues, everyday stressors, and daily routines have the ability to distract anyone and everyone.

The key to avoiding this kind of situation? Always look before you lock. Keep these six tips in mind to prevent a child or pet from experiencing heatstroke:

- Never, ever leave a child or pet unattended in a vehicle, no matter how quickly you think you will return. Two-thirds of heating occurs in the first 20 minutes of parking a car.

- Even on a cool day, in-car temperatures can spike to life-threatening levels. A car can bake to 113 degrees on a mild 70-degree day. In fact, heat stroke can take place when the outside temperature is as low as 57 degrees, according to HealthyChildren.org.

- Thinking of cracking a window or parking in the shade? Think again. Studies show that these actions do little, if anything, to sufficiently quell the rising temperatures.

- Leave an important item in the backseat with your child – like your cellphone or even a shoe. If you make it a habit to leave something you need in the back seat every time you buckle up your child, you will be giving yourself one more reason to check that area of the vehicle before you walk away.

- Lock your car every time you exit the vehicle. Thirty percent of heat stroke deaths occur because the child got in a car without a caregiver knowing and couldn’t get back out.

- Protect others! If you see a child or pet in a hot car, call for help immediately. In most cases, even waiting a few minutes could be detrimental.

>> At Kentucky Farm Bureau, we protect what’s important to you – from farms and fishing boats to minivans and mobile homes. To see a full list of products we insure, click here.

Weekly Economic Report - June 30, 2025

Corey Culbreth

About Us

Farm Bureau is a voluntary organization operating under the code 501(c)5 not-for-profit guided and directed by our nearly 13,000 member families. We are committed to educating the public about agriculture, encouraging youth in advancing education and leadership skills and contributing to our community to make Fayette County the best place to live, work, raise a family and have a great quality of life.

OFFICERS

| President | Robert Cole James | |

| Vice President | Patrick Robinson | |

| Secretary | Phil Meyer | |

| Treasurer | Nick Carter | |

| Executive Director | Carrie McIntosh | |

| Farm Bureau Women's Chair | Bonnie Eads | |

| Young Farmer Chair | Paige Mattingly | |

| DIRECTORS | ||

| Nick Carter | Paris | |

| Aaron Clark | Lexington | |

| Todd Clark | Lexington | |

| Brian Colon | Lexington | |

| Ben Conner | Lexington | |

| Tanya Dvorak | Lexington | |

| Bonnie Eads | Lexington | |

| Rob Eads | Lexington | |

| John Evans | Lexington | |

| Brennan Gilkison | Winchester | |

| Patrick Higginbotham | Lexington | |

| Robert James | Lexington | |

| Jill Mahan | Lexington | |

| Carrie McIntosh | Lexington | |

| John T McGuire | Winchester | |

| Philip Meyer | Lexington | |

| Beau Neal | Lexington | |

| Christopher Riggs | Wilmore | |

| Patrick Robinson | Lexington | |

| Larry Ryan | Lexington | |

| John Tucker | Lexington | |

| Stuart Turlington | Lexington | |

| Billy Van Pelt | Lexington | |

| Stacy K. Vincent | Versailles | |

| Jason Whitis | Lexington | |

| Bill Witt | Lexington |

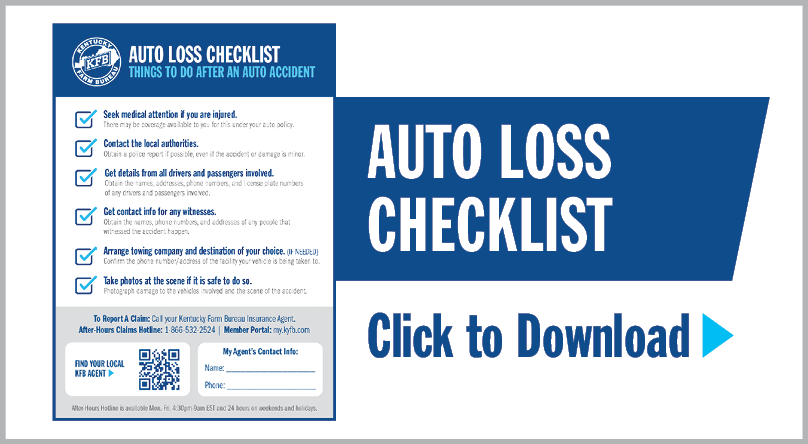

Important Things To Do After An Auto Loss

If you are involved in an auto accident, please tend to the safety of everyone involved first. Once it is safe to do so, there are some other actions you can take to help us process your auto claim.

- Seek medical attention if you are injured. There may be coverage available to you for this under your auto policy.

- Contact the local authorities. Obtain a police report if possible – even if the accident or damage is minor.

- Get details from all drivers and passengers involved. Count the total number of people in all vehicles involved in the accident and obtain their names, addresses, phone numbers and license plate numbers of any vehicles involved.

- Get the names, phone numbers and addresses of any witnesses present.

- If your vehicle is being towed, find out where. It’s important to get the phone number and location of the wrecker service that tows your vehicle or the repair facility that it’s taken to.

- Take photos at the scene if it is safe to do so. These can include:

- Damage to the vehicles involved

- Scene of accident

- Please keep your safety in mind when taking photos and don’t put yourself at risk!

- Report the claim by calling your local Kentucky Farm Bureau Agent’s office or by calling the after-hours claims reporting hotline.

Download our Auto Loss Checklist

It's important that our members know what to do in the event of an auto accident. We offer a handy checklist that you can download, print, and keep in your vehicle for quick reference.

Claim FAQs

Let’s face it, insurance can be complex. Kentucky Farm Bureau is here to make it simple.

Got a question? Choose a topic below to explore a list of common inquiries and their answers.

If you don’t find what you’re looking for here, KFB has 15 Regional Claim Offices throughout the state. Find a Regional Office near you.

Important Things To Do After A Property Loss

First and foremost, make sure everyone in your family is safe, and get medical care if anyone has been injured. Once it is safe to do so, there are some other actions you can take to help us process your claim.

- Contact the local authorities in the event of a theft loss or burglary claim. Obtain an incident report if possible – even if the damage is minor.

- If your home is damaged, take steps to secure it and protect it from further loss or damage. Protect your property by sealing broken windows, putting tarps over cracks or openings in exterior walls or the roof, and do whatever else you can to prevent additional damage. Keep receipts for any materials you buy; those costs may be reimbursable if you have a covered loss.

- Report the claim by calling your local Kentucky Farm Bureau Agent’s office or by calling the after-hours claims reporting hotline.

- If your loss is severe or has many rooms affected, start preparing a room-by-room inventory of damages and lost property. If you have the information, or remember it, include manufacturer names, model numbers, and purchase dates.

- If possible, do not dispose of any damaged items – especially if an item may be responsible for the loss. Examples of this could be a water heater or a stove. If a damaged item has to be disposed of because of personal safety or by order of the authorities, try to document it with photographs first.

- In the event of a widespread catastrophe, begin the process of selecting your contractor. We suggest that you seek out contractors who have a proven track record in your area. To help ensure that you choose a reliable contractor:

- Get references from any contractor you interview, and check them.

- Contact your local Better Business Bureau for information about the contractors you’re considering.

- Don’t sign a contract until you’ve reviewed it carefully and have agreed to payment terms. Deliver a copy of your contractor’s estimate to your KFB claims representative, who will review it, connect with your contractor to discuss differences and make any appropriate adjustments. Our estimate will be based on typical labor and materials rates in your community.

For more tips on choosing a contractor, click here for helpful information from the the Kentucky Attorney General’s office.

Download our Property Loss Checklist

It's important that our members know what to do in the event of property damage or loss. We offer a handy checklist that you can download, print, and keep in your home for quick reference.

Auto Loss Reporting

When you’ve had an accident, Kentucky Farm Bureau will partner with you to handle your covered claim and help you get your vehicle repaired. To report a claim during normal business hours, please call your local Kentucky Farm Bureau Agent's office.

To report a claim during normal business hours:

Please call your local Kentucky Farm Bureau Agent's office

To report a new claim after business hours:

Please call our After-Hours Claims Reporting Hotline

1-866-KFB-Claim (1-866-532-2524)

4:30 p.m. until 9:00 a.m. (EST), Monday through Friday

24 hours on weekends and holidays

Above all else, make sure that you and everyone involved in the accident are safe before reporting your auto claim.

Whether you submit your claim during regular business hours or after hours, your report will be more complete if you have the following information available for the customer service representative:

- Your Kentucky Farm Bureau Insurance auto policy number

- Name and contact phone number for all of the involved parties including:

- Owner of your vehicle

- Driver of your vehicle (if different)

- Passengers in your vehicle

- Owner and driver of any other vehicle involved in the accident

- Witnesses

- Any other involved parties, including the wrecker service or repair shop where your vehicle has been towed

- List of vehicles/property involved

- Date and time the loss occurred

- Location of the loss or accident

- A description of what happened

- Description of damage and/or injuries

- Police report number

Report A Claim

To report a claim during normal business hours, please call your local Kentucky Farm Bureau Agent's office.

To report a new claim after business hours, please call:

After-Hours Claims Reporting Hotline

1-866-KFB-Claim (1-866-532-2524)

4:30 p.m. until 9:00 a.m. (EST), Monday through Friday

24 hours on weekends and holidays

Whichever reporting option you use, your report will be more complete if you have the following information available for the customer service representative:

- Date and time the loss occurred

- Location of loss or accident

- List of vehicles/property/people involved

- A description of what happened

- Names, addresses and phone numbers of all those involved

- Description of damage and/or injuries

- Police report number

- Names, addresses, and phone numbers of any witnesses

- Name and phone number for whom we should contact to discuss the claim

Claims Information

Important things to do when you have a loss:

- In case of an auto accident or a home burglary, call the police and obtain a police report–even if the loss or damage is minor.

- Notify Kentucky Farm Bureau Insurance promptly.

- In an auto accident, get this information from others who are involved:

- Names, addresses, phone numbers, license plate numbers of vehicles involved, number of people in the vehicles.

- Names, addresses, and phone numbers of any witnesses.

- If your home is damaged, take steps to secure it and protect it from further damage or loss. If temporary repairs are required to provide the needed protection, you may be reimbursed for reasonable expenses you incur (check with your local agent.)

Download our Auto & Property Loss Checklists

It's important that our members know what to do in the event of an auto accident or property damage. We offer handy checklists that you can download, print, and keep in your vehicle or in your home for quick reference.

Motorcycle Insurance

Kentuckians have long known Kentucky Farm Bureau as their hometown provider of home and auto insurance. But have you heard the rumblings? We now offer great rates on coverage for motorcycles, too! Whether you're cruising Kentucky's country roads on a classic chopper, touring cycle, or a sport bike, we've got you covered.

Contact your local Kentucky Farm Bureau Insurance agent for more details about policy coverages and availability. No matter where you live in Kentucky, there's a local agent near you.

Coverage options

Kentucky Farm Bureau Insurance offers the following motorcycle insurance coverage:

Motorcycle liability coverage

- Bodily injury liability

- Property damage liability

Motorcycle physical damage coverage

- Collision

- Other than collision

Coverage for added protection

- Uninsured motorists

- Underinsured motorists

- Personal injury protection

- Basic personal injury protection

- Passenger personal injury protection

- Pedestrian personal injury protection

- Customizing equipment coverage

- Rider safety apparel coverage

Other coverage options

- Medical payments coverage

- Towing and labor cost coverage

- Trip interruption coverage

- Replacement cost coverage for your motorcycle

- Replacement cost coverage for customizing equipment

* We can also offer coverage for motorcycle cargo trailers and motorcycle transport trailers under this same policy.

Ways to save

Check out a brief description of some of our discounts below. If you're interested in learning more, chat with your local agent for specific rules and eligibilities.

Claims Free Discount

Earn discounts based on claims free driving!

Farm Association Discount

Are you a member of a farming association? If so, you may qualify for a discount!

Loyalty Discount

Have you been a Kentucky Farm Bureau member? If so, you may qualify for a discount!

Motorcycle Association Discount

Are you a member of a motorcycle association? If so, you may qualify for a discount!

Multi-policy Discount

Do you carry multiple lines of insurance coverage through us? You can save on your premiums when you carry your homeowner, farmowner, mobile home, and automobile policies with Kentucky Farm Bureau Insurance.

Heritage Discount

Are you classified as a "regular" KFB member? If you are, you're eligible for a discount on your motorcycle insurance. Thank you for putting the "farm" in Kentucky Farm Bureau!

Safety Device Discount

Is your motorcycle equipped with anti-lock brakes or anti-theft devices? You may be eligible for a discount!

Seasonal Use Discount

Do you only occasionally use your motorcycle during the months of December, January and February? If so, you may be eligible for a discount.

Defensive Driving Course Discount

- Senior Operator Accident Prevention

We honor drivers aged 55 and older who successfully complete an approved safety course. Provide us with a certificate of completion, we’ll save you some green. - Military Defensive Driving Course

We salute members of the United States Armed Forces who have taken a defensive driving course provided by the U.S. Armed Forces. Drivers must submit a certificate showing completion of an approved defensive driving course. Thank you for your service!

Motorcycle Safety Discount

Have you completed a motorcycle accident prevention class? If so, you may be eligible for a discount!

What to do if you're involved in an accident

If you have been involved in an accident, click here for instructions on what to do next.

For answers to frequently asked questions regarding motorcycle claims, click here.

Download our Auto Loss Checklist. Print it out and keep it in your vehicle for quick reference.

About Kentucky Farm Bureau Insurance

Kentucky Farm Bureau Insurance has been serving families of the Bluegrass since 1943. We are the largest property and casualty insurance company in Kentucky. We're located where our customers are — in each and every one of the 120 counties in the Commonwealth. Tired of dealing with a computer or answering service? We're hometown people ready to serve you on a personal basis.

Kentucky Farm Bureau Insurance is rated A- (excellent) by A.M. Best, the most respected name in insurance rating services. In addition, we are currently rated an A+ with the Better Business Bureau (BBB). BBB ratings are based on 13 trust-related factors, including fair and appropriate handling of any customer complaints filed with BBB, business stability as represented by numerous years of business, and compliance with BBB’s Standards of Trust.