Allen County 4-H Reality Store

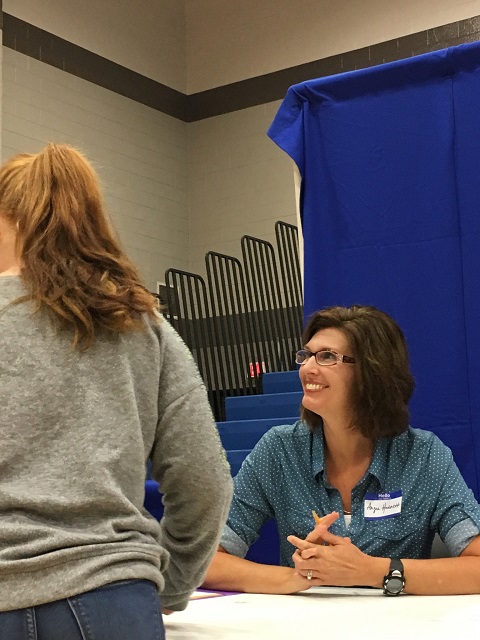

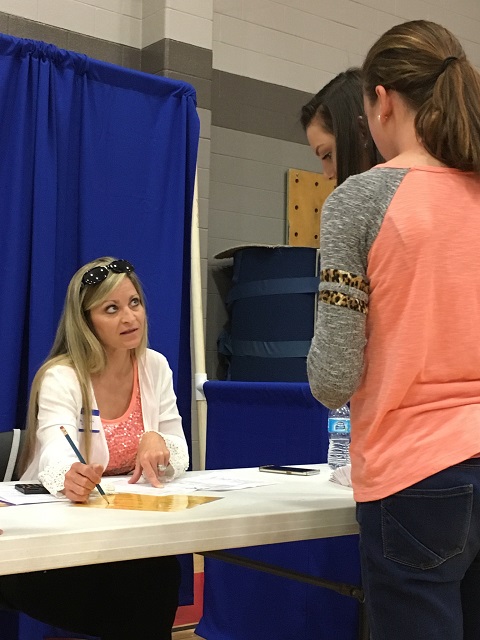

Along with other community businesses, Allen County Farm Bureau representatives Angie Hodnett and Christy Lautieri had the honor of taking part in this year's 4-H Reality Store on April 13, 2017.

The 4-H Reality Store is sponsored by the Allen County School's Youth Service Center and the Cooperative Extension Service.

The purpose of the 4-H Reality Store is to increase awareness of the importance of education and its effect on the 8th grade students who participated. The students visit the "mock community" to spend their salaries for basic living expenses (after taxes are paid). Students have the opportunity to demonstrate and learn skills in decision making, goal setting, financial planning, and career selection.

Thank you to the Allen County Youth Service Center and Cooperative Extension Service for the opportunity to serve during this wonderful educational experience.

KFB Spotlight

- Candid Conversation: Tori Embry

- June 9, 2025

-

-

This month’s Candid Conversation features Tori Embry, the Executive Director of the Kentucky Dairy Development Council,

who discusses all things dairy. She will also be a guest on an upcoming Farm Life podcast.

- Champions... Again

- June 9, 2025

-

-

Spencer County’s dairy judging team continues to be the best in the nation and will soon

compete on an international stage.

- Making Their Own Market for Milk: The Goode family expanded their dairy farm in a value-added way

- June 9, 2025

-

-

Join us as we celebrate Dairy Month with a visit to Casey County and the Goode Family! They have recently expanded their dairy operation by way of Goode's Riverside Creamery, featuring products made with their fresh-from-the-farm milk.